What is Earnest Money Deposit

- amount of earnest money

- buy a home

- credit scores

- deposit directly to the seller

- escrow company

- funds are held

- good faith deposit

- held in an escrow account

- home inspection

- losing your earnest money deposit

- payment and closing costs

- purchase agreement

- purchase contract

- purchase price

- real estate agent

- real estate markets

- real estate transaction

- sales contract

- sales price

- title company

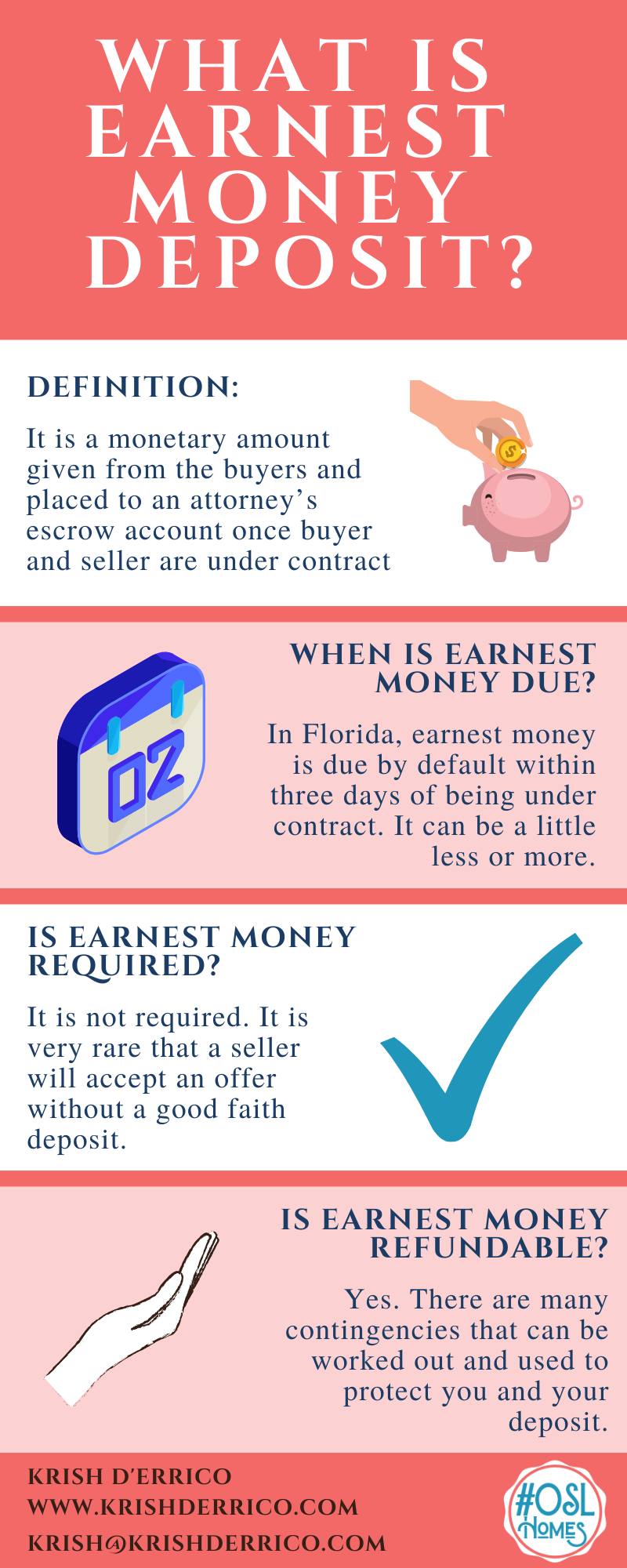

Earnest Money Deposit – What You Need to Know to Protect Yourself

Would you like to know what is earnest money deposit? Here are the top 5 things you must know about earnest money deposit

-

What is earnest money deposit?

-

When is earnest money due?

-

Is earnest money required?

-

Is earnest money refundable?

-

What if I don’t have earnest money?

-

When can seller keep earnest money?

What is earnest money deposit?

The earnest money deposit is a monetary amount from the buyers to the sellers. Hence, until the buyer and seller are under contract It is deposited in the escrow account of an attorney. Normally, about 500-5000 dollars are expected. Depending on the price of the home, it can be more. This lets the sellers know you are serious about buying the home. In good faith, you will be able to fulfill the deal.

Other known names: Escrow, EMD, Good faith deposit, escrow deposit, escrow money.

Watch Full Video Here:

When is earnest money due?

In Florida, earnest money is due by default within three days of being under contract. It can be a little less or more. The buyer does this as soon as possible. Aim for the same day or next day. The title company in which the escrow deposit is held will email you wiring instructions. The preferred way to submit escrow is through a wire. Due to increased wire fraud, remember to call your Title Company to confirm wire route and account numbers before sending any wires.

Is earnest money required?

Although it is not required, it’s very rare that a seller will accept an offer without a good faith deposit.

Suggested Read:

FREE Buyer Guide

Tips for Good Credit

The Pre Qualification Process

Making an Offer on A House Tips

What is the Earnest Money Deposit?

What is Due Diligence in Real Estate

Reasonable Requests After Home Inspection

What Happens The Week Before Closing on A House

Closing Day on a House

Is earnest money refundable?

Yes. There are many contingencies that can be worked into the contract when making an offer and used to protect you and your deposit. Common contingencies are inspection contingency, appraisal contingency, finance contingencies. They are requirements needed to move on with the purchase.

The other party is entitled to retain the deposit if a party does not reach its conclusion of the deal. Your Realtor® should work with you on this and customize the offer based upon your unique situation.

You pay your money to buy your house with earnest money. For example, if you spend $5000 on a $250,000 home . Those who owe your loan would probably be $245,000. The money from the deposit must be supplied in cash up front and will not be included with the loan.

CLICK HERE FOR YOUR FREE BUYER GUIDE

When can seller keep earnest money?

The buyer most often has the right to a deposit, but the vendor can keep the deposit. This happens when the buyer does not do the required action within the time frames agreed upon in the contract terms.

What if I don’t have earnest money?

We do not recommend placing an offer without an earnest money deposit. EMD can be as little as $500, so this may be another option for you. Also, never get out a loan for the earnest money deposit. This may stop you from closing on the house altogether or delay closing.

Suggested Read:

FREE Buyer Guide

Tips for Good Credit

The Pre Qualification Process

Making an Offer on A House Tips

What is the Earnest Money Deposit?

What is Due Diligence in Real Estate

Reasonable Requests After Home Inspection

What Happens The Week Before Closing on A House

Closing Day on a House

Connect With Us

In conclusion, whether you are buying a home, selling a home, thinking of moving to the Orlando Area or just browsing, make sure you get the latest market updates, tips on selling, moving hacks and so much more by following Krish on YouTube, Pinterest, Facebook, and Instagram.