Pre-Qualification Process

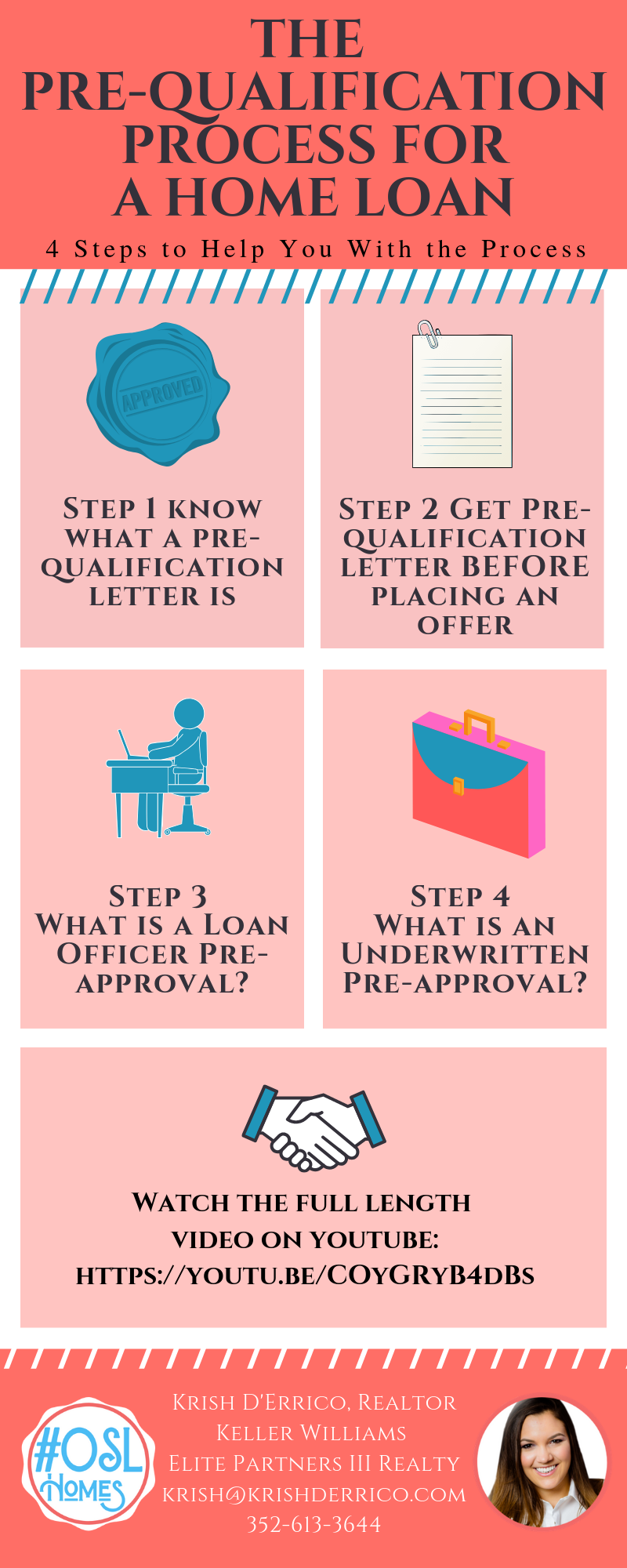

4 Steps to Help You with the Pre Qualification Process for a Home Loan

Would you like to know about how the pre-qualification process works for a home loan? We will get you prepared with 4 steps to educate you about the process. We will learn about the pre-qualification vs pre-approval, mortgage pre-approval process, and what it means to be pre-qualified.

Step 1 Pre-qualification letter BEFORE placing an offer

You need to have a pre-qualification letter and this pre-qualification letter will basically mean that you have a strong financial backing and because you have a strong financial backing you’re able to prove that you have the funds to buy that home. Presenting a strong offer works in your favor and you want to get that house don’t you?

Watch the Video Version Here:

Step 2 What is a Pre-qualification?

A pre-qualification is when a lender takes your basic financial information and runs your credit score. That’s it.

Step 3 What is a Loan Officer Pre-approval?

So there’s actually two different types of pre-approvals that you can obtain. The first pre-approval is a loan officer for approval. And that’s where they take your application and they ask for additional documents such as w-2s, tax returns and anything else they need to back up that information in your initial application.

Suggested Read:

FREE Home Buyer Guide

Tips for Good Credit

The Pre Qualification Process

Making an Offer on A House Tips

What is the Earnest Money Deposit?

What is Due Diligence in Real Estate

Reasonable Requests After Home Inspection

What Happens The Week Before Closing on A House

Closing Day on a House

Step 4 What is an Underwritten Pre-approval?

Remember there are two different types of pre-approvals. Therefore, this one is a fully underwritten pre-approval. Underwriting means an additional step is done to verify the information. With the underwriter they actually do back reports. No one else can do these reports besides them. They do these reports so that they can see any additional information that needs to be brought up before closing because these issues can eventually prevent us from closing.

Connect With Us

In conclusion, whether you are buying a home, selling a home, thinking of moving to the Orlando Area or just browsing, make sure you get the latest market updates, tips on selling, moving hacks and so much more by following Krish on YouTube, Pinterest, Facebook, and Instagram.